CA Coaching in Hyderabad

by Aja Commerce Academy

The Chartered Accountancy (CA) is one of the most pursued courses by aspirants seeking a professional position in the finance industry or finance department of a company.

Register Now

Playlist

The CA course has three levels

An individual pursuing a CA course also needs to complete three years of practical training called ‘Articleship.’ For aspirants opting for the foundation course, the average course duration will be around four years and six months, but additional attempts to clear exams may extend the duration further.

About Aja Commerce Academy

Aja Commerce Academy, formed in 2015, is a reputed institute offering CA coaching in Hyderabad for aspirants pursuing the CA course. We provide them with comprehensive, high-quality coaching for the foundation course and intermediate levels. With our unique, effective teaching methods, affordable fee structure, and the ability to consistently get the best results for our students, we are today regarded as the best CA Coaching institute in Hyderabad.

360 degree view of AJA Commerce Academy

Key Features of the CA course

- Affordable fees

- Interactive learning sessions

- Useful tips and tricks by experts

- Practice sessions and tests

- Doubt-clearing sessions

- Subject-intensive coaching

- Experienced teachers

Highlights of the CA course

- Personalized attention

- Experienced faculty

- State-of-the-art Infrastructure

- Concept-based teaching

- Well-researched study materials

Register Now

Why should I Join Aja Academy?

By enrolling at Aja Academy, the top institute for CA coaching in Hyderabad,

you can expect a plethora of benefits. Some of the key ones are:

Highly-qualified faculty

All faculty members at Aja have at least a Chartered Accountant degree, while some even have other additional professional qualifications.

Learn from experienced professors

Each faculty member possesses rich experience in the Academic arena, with some of them also possessing in-depth experience in the corporate world as well.

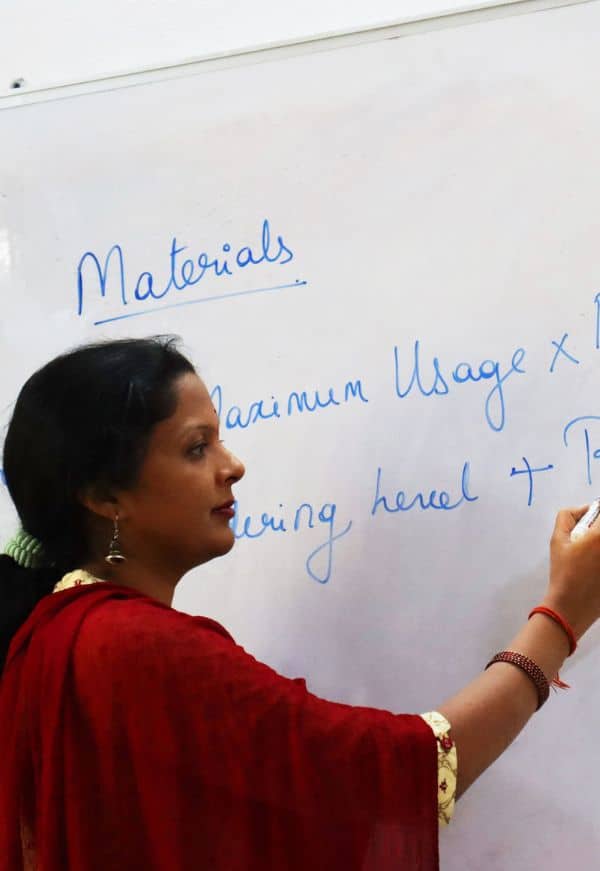

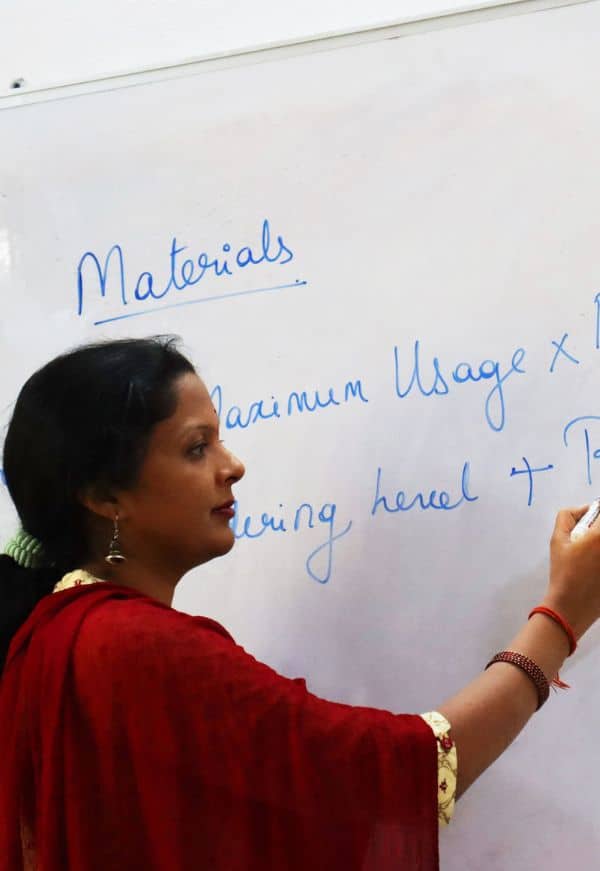

Innovative Concept-based Coaching

At Aja, along with theoretical knowledge, we teach students how to practically apply in the real world the concepts they learn in our course.

Well-researched Study Material

We will provide you with the most comprehensive study material based on the latest syllabus released by the ICAI institute to help you perform excellently in the exams.

Get special Tips and Tricks from our experts

Our experienced faculty will give you useful tips for solving complex problems, time management hacks, and other quick solutions.

This is one of the best academies in Hyderabad. The faculty works on individual student's strength to make it core strength and weakness to convert it into strength. The style of teaching and practical examples make it easy for students to get a strong grip on the subjects. I would like to thank Sushma Madam for taking a great initiative and making Aja Commerce Academy the best path to building a CA/CMA student's career.

Excellent coaching for commerce students! Each and every subject is very well taught and made simple & fun. very experienced faculty to help students coming from other backgrounds too. One of the best Coaching Centres in Hyderabad!!

It's an amazing institution where the toughest subjects are taught in the easiest manner and Sushma ma'am is very encouraging and helpful. The things I like about Aja Commerce Academy include faculty knowledge, teaching style and tips and tricks for scoring well.

Excellent coaching with focus on concepts, understanding and presentation. Sushma Mam explains from the basics and makes the subject easy by linking with practical aspects. Highly recommended for all commerce students.

Who can learn the CA course?

Any student aspiring to be a finance professional can learn the CA course. To register for the CA course, students must clear the CA Foundation exam, conducted on a national level twice a year. A candidate appearing for class 12 or one who has already written the exam or its equivalent can register for the foundation exam. Even a candidate passing the class 10 exam can apply. But such a student will only get provisional admission that will be regularized after passing class 12. Aja Academy is reputed to be the best CA Coaching institute in Hyderabad for the Foundation exam because of the high success rate of its students.

Why should you pursue CA ?

Every organization needs a chartered accountant to handle its accounting, financial, and auditing needs. The CA course is a stable and flexible profession that offers financial security and opens the door to numerous lucrative opportunities in the corporate world.

Career Opportunities in CA?

A CA course is one of the most highly-paid professions in India that is in great demand even in foreign countries. After completing the course, you are eligible to apply for respectable positions like a Tax accountant, Financial Accountant, Financial Analyst, or Budget Analyst. A newly qualified CA can expect a pay package of around INR 5 to 7 lakhs per annum. Moreover, CA professionals can even start their business, such as a consultancy providing accounting, audit, and taxation services. Under the expert guidance of Aja Academy, the best CA Coaching institute in Hyderabad, you can crack the CA exams on your first attempt itself.

Years Of Experience

CA Courses at AJA Commerce Academy

CA Foundation Coaching

It is the first level of the CA course that you have to clear to become a chartered accountant. Through our CA foundation course, our experts will help you easily grasp the concepts of business laws, accounting, mathematics, and economics.

CA Inter (Group 1)

Our well-planned CA Inter (Group 1) course will prepare you well for its four papers, including direct and indirect taxation, basics of The Companies Act and other essential laws, basic and advanced accounting concepts, and cost & management accounting.

CA Inter (Group 2)

In our CA Inter (Group 2) course, our experts will teach you concepts like auditing, its process, the various auditing standards, basic and advanced accounting concepts, information systems, and strategic management process, financial management, and macroeconomics,

CA Final

The CA Final course is the last level to be cleared by CA aspirants who are well-versed with the various aspects of finance. CA Final classes help students understand much more complex topics such as cost management, pricing, budgeting and variance analysis

Register Now

Aja Commerce Academy is reputed for being the best CA Coaching institute in Hyderabad

and is the most sought-after institute for the CA foundation and inter levels.

Teaching Modes

We are providing Online and Offline CA Coaching in Hyderabad

Online

Our online classes employ cutting-edge tools and software to provide an uninterrupted learning experience to students. Our sessions are interactive with special doubt-clearing sessions to solve all your doubts. You will receive personalized attention and timely feedback to help you improve and learn from your mistakes.

Classroom (Only in Hyderabad centre)

We provide state-of-the-art infrastructure and an excellent study atmosphere conducive to learning and development. Through modern teaching techniques, we make you easily understand even the most complex topics.

About the Faculty

At Aja, we have the best faculty with impressive professional qualifications and years of rich academic and corporate experience. Our friendly, dedicated professors pay personal attention to each student, solving their problems, helping them identify their weaknesses, and maximizing their strengths.

Prerequisites for the CA course

- For the CA foundation course, you need to be in class 12 or have passed class 12 with a minimum of 50% marks.

- To appear for CA inter exams, you need to have cleared the foundation course.

Frequently Asked Questions

You can complete your registration for the CA foundation exam scheduled in November/December 2022 by August 14th, 2022.

You can download the form from the ICAI website by selecting the ‘Students’ Menu and then clicking on Course Registration Forms.

A student appearing for class 12 can register with the board of studies but can attempt the examination only after passing the class 12 exam.

Follow these tips to prepare for CA intermediate exams:

- Know the syllabus well, and create a study plan

- Set yourself daily targets

- Dont mug the topics. Thoroughly understand them.

- Solve ICAI mock papers and previous year papers.

- Master time management skills

- Join the Best CA Coaching institute in Hyderabad

Register Now

More

Any student who is appearing for 12th class can register with Board of Studies. After completion of four months study period and after qualifying Class XII examination, a student can appear for Foundation examination after passing 10+2 Examination.

Visit the ICAI official website and select “Students” menu from the top menu. Click on the BoS knowledge portal from the drop-down menu. Choose foundation course from the list. Click on the paper for which you wish to download the question paper. Then click on the “Suggested answers”. Choose the suggested answer year. Download the answer in pdf mode.

Yes. The ICAI allows a candidate to enter directly to its Intermediate Course who is a Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60% marks).

Foreign Accounting Body Members will be asked to state their preference of exam session date and location on the ICAI registration form. Further information will be forwarded by the ICAI following successful registration. Candidates must apply for examinations in the prescribed format, and submit all relevant materials.

MoU/MRA/Joint Declarations signed with Foreign Bodies

Qualification Reciprocity Arrangement

|

Bilateral Co-operations

|

Unilateral Agreements/Pilot International Pathway Programme

|

Yes. ICAI will release the release the question paper and answers for the mock tests conducted. However, Southern India Regional Council of the ICAI will release the marks. Click on the students menu in the top menu, in which find SIRC mock Tests.

Any student who is appearing for 12th class can register with Board of Studies. After completion of four months study period and after qualifying Class XII examination, a student can appear for Foundation examination after passing 10+2 Examination.

Visit the ICAI official website and select “Students” menu from the top menu. Click on the BoS knowledge portal from the drop-down menu. Choose foundation course from the list. Click on the paper for which you wish to download the question paper. Then click on the “Suggested answers”. Choose the suggested answer year. Download the answer in pdf mode.

Analysis of past examination papers reveals that around 50 per cent of the questions in the ICAI exams comes from the official material and sources i.e., modules, practice manuals, mock tests, current RTP and past year RTP. Sometimes, final examination questions directly comes from the RTPs and many times the questions as ked in the exam are very close to the questions in the RTPs.

Students can download the foundation registration form by visiting ICAI website and select “Students” menu and select course registration forms.

The last date for CA foundation registration is 31st December 2019 for appearing in May 2020 examination and 30th June 2020 for appearing November 2020 Examination. The schedule for the examinations will be published in ICAI website in due course.

The following schedule is helpful for the students:

- Divide the study plan into three phases i.e., Learning phase, review phase and revision phase.

- Set the daily targets with self-study

- Review the previous studies daily before starting today’s study

- Appropriate use of the information/data available in internet

- Use the weekends sparingly with increased study hours

Always suggestable to study Institute study material and Revision Test Papers, suggested answers and practice manuals

The following is the exemptions available while converting into old syllabus to new:

Exemption in paper/s granted in the Intermediate (IPC) Examination | Exemption in corresponding paper/s in the Intermediate examination under regulation 28G(4), with effect from May 2018 |

Group I – Paper 1 : Accounting | Group I – Paper 1 : Accounting |

Group I – Paper 2 : Business Laws, Ethics and Communication | Group I – Paper 2 : Corporate & Other laws |

Group I – Paper 3 : Cost Accounting and Financial Management | Group I – Paper 3 : Cost and Management Accounting AND Group II – Paper 8 : Financial Management & Economics for Finance |

Group I – Paper 4 : Taxation | Group I – Paper 4 : Taxation Section A : Income Tax Law Section B : Indirect Taxes |

Group II – Paper 5 : Advanced Accounting | Group II – Paper 5 : Advanced Accounting |

Group II – Paper 6 : Auditing and Assurance | Group II – Paper 6 : Auditing and Assurance |

Group II – Paper 7 : Information Technology & Strategic Management Section A : Information Technology Section B : Strategic Management | Group II – Paper 7 : Enterprise Information Systems & Strategic Management Section A : Enterprise Information Systems Section B : Strategic Management |

It is suggestable to give importance to all the chapters equally. An equal weightage is given to all the chapters.

Visit the ICAI official website and select “Students” menu from the top menu. Click on the BoS knowledge portal from the drop-down menu. Choose foundation course from the list. Click on the paper for which you wish to download the question paper. Then click on the “Suggested answers”. Choose the suggested answer year. Download the answer in pdf mode.

Yes. The ICAI allows a candidate to enter directly to its Intermediate Course who is a Commerce Graduates/Post-Graduates (with minimum 55% marks) or Other Graduates/Post-Graduates (with minimum 60% marks).

Foreign Accounting Body Members will be asked to state their preference of exam session date and location on the ICAI registration form. Further information will be forwarded by the ICAI following successful registration. Candidates must apply for examinations in the prescribed format, and submit all relevant materials.

MoU/MRA/Joint Declarations signed with Foreign Bodies

Qualification Reciprocity Arrangement

|

Bilateral Co-operations

|

Unilateral Agreements/Pilot International Pathway Programme

|

Yes. ICAI will release the release the question paper and answers for the mock tests conducted. However, Southern India Regional Council of the ICAI will release the marks. Click on the students menu in the top menu, in which find SIRC mock Tests.