The Chartered Accountancy (CA) is one of the most pursued courses by aspirants seeking a professional position in the finance industry or finance department of a company.

Importance and benefits of pursuing the course

We have had over 12.56k students join our institute who take pride in achieving their dreams with Aja Commerce Academy for CA coaching in Hyderabad. Moreover, we have been recognised and featured in the list of Top 10 Finance and Accounting Coaching Institutes in India by Higher Education Review Magazine.

Eligibilty

Research based Teaching Techniques

Offline Only

Small batch sizes

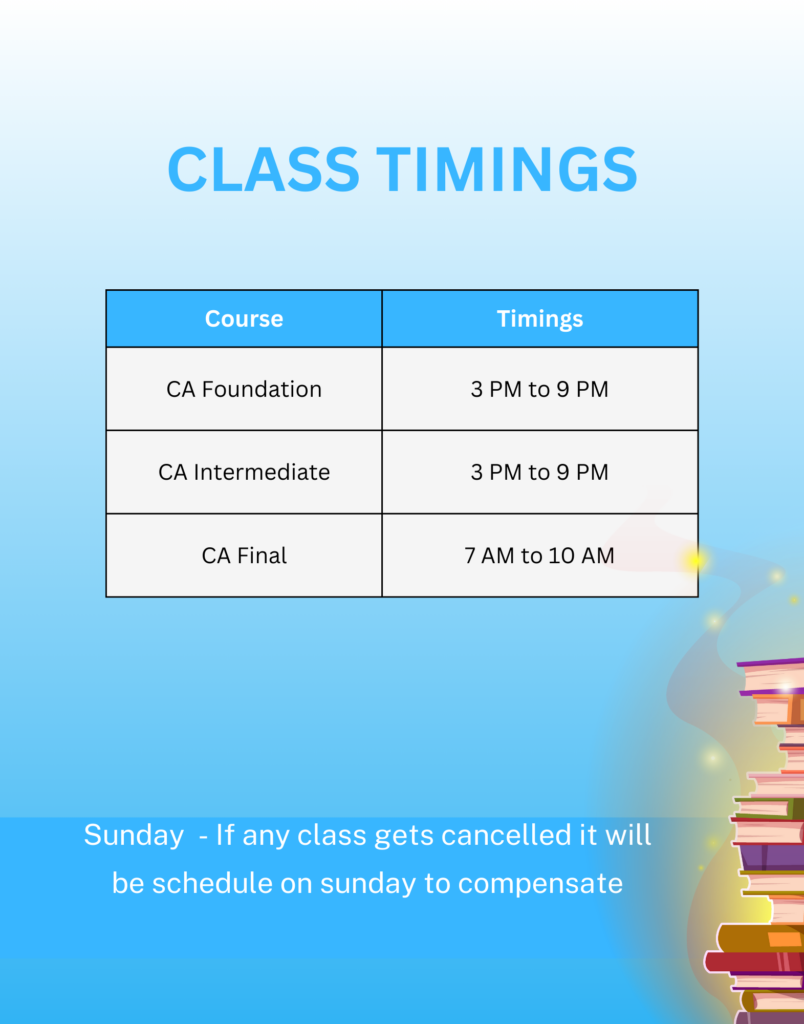

Time Table

An individual pursuing a CA course also needs to complete three years of practical training called ‘Articleship.’ For aspirants opting for the foundation course, the average course duration will be around four years and six months, but additional attempts to clear exams may extend the duration further.

CA Foundation

CA Intermediate

CA Final

Course Details

- 100% Classroom

- English

- Flexible deadlines

- Final Level

- Mock Test

Eligibilty

CA Final Eligibility:

1. Clearing CA Intermediate

Candidates must have cleared both groups of the CA Intermediate level conducted by ICAI.

2. Completion of Articleship

Must have completed Articleship training under a practicing Chartered Accountant.

However, candidates can appear for the CA Final exams during the last six months of their Articleship training.

3. Completion of Advanced ICITSS

Candidates must complete the Advanced Integrated Course on Information Technology and Soft Skills (Advanced ICITSS) before appearing for the CA Final exams.

Mock Tests and Practice Sessions

Aja Commerce Academy conducts regular mock tests and practice tests for enhanced understanding and to help students prepare well beforehand. These tests help students evaluate their level of understanding of the topics covered in the syllabus and identify areas where they need to improve. It also helps them become familiar with the exam format and reduce anxiety on the day of the examination.

Continuous Feedback and Monitoring

At Aja students and parents get enough and ongoing opportunities to know their progress and keep improving. We make success a consequence of our process for the students. Less surprises and more assurance

Extensive Coverage of Case Studies

At Aja we ensure that CA Final students are taught extensively about the recent and landmark judgements of Supreme Court and High Court so that they can be handy tools to answer questions in exams. Decided case laws being directly accepted by ICAI as part of the answer. We ensure students cross the milestone of thoroughness early enough to reach mastery over the subject.

FAQs about CA Final Course

You can complete your registration for the CA foundation exam scheduled in November/December 2022 by August 14th, 2022.

You can download the form from the ICAI website by selecting the ‘Students’ Menu and then clicking on Course Registration Forms.

A student appearing for class 12 can register with the board of studies but can attempt the examination only after passing the class 12 exam.

Follow these tips to prepare for CA intermediate exams:

Know the syllabus well, and create a study plan

Set yourself daily targets

Dont mug the topics. Thoroughly understand them.

Solve ICAI mock papers and previous year papers.

Master time management skills

Join the Best CA Coaching institute in Hyderabad

Have a Question? Let’s Talk

If you are confused or in doubt,

contact us, we will be happy to help.